How Proactive SMS Fights Involuntary Churn

Customer retention is key to the success of any business. But even the companies with the best retention strategies will lose customers. However, there’s a difference between customers who terminate their service intentionally — called voluntary churn — and those who lose service without meaning to. The latter phenomenon is known as involuntary churn or “soft” churn, and it’s a big problem that can be tough to solve.

The impact of involuntary churn goes beyond lost revenue. It’s also about having to regain churned customers. Many consumers today are overwhelmed by a barrage of messages from numerous companies, all while grappling with the intricacies of a constantly evolving payment landscape. Getting individuals to resolve payment issues becomes a frustrating task, especially considering their busy lives.

This form of customer churn poses unique challenges for businesses. It highlights everything from operational inefficiencies to billing system errors, both of which lead to payment failures. According to one study, involuntary churn accounts for as much as 34% of the overall churn rate (The CX Lead). As a result, developing strategies that address and reduce involuntary churn is crucial to sustaining a successful business.

Understanding The Root Causes Of Involuntary Churn

Involuntary churn arises from various sources, each posing its own unique challenges. One of the most common causes is payment failure. According to Visa and Mastercard, approximately 15% of recurring payments are declined. For some industries, it can be double that (ChargeBee).

Soft Declines

A soft decline occurs when the issuing bank approves a payment, but the transaction fails. Soft declines are temporary issues, meaning that the payment method will become valid if the issue is resolved. Soft declines make up 80%-90% of payment failures (Checkout.com). They can be caused by any of the following factors.

- Insufficient funds: Sometimes, customers find themselves short of the necessary funds to cover their purchase. This could be due to a change in their financial circumstances, or it could just be a timing issue.

- Credit limit exceeded: If a credit card reaches its limit, the customer won’t be able to make more purchases until paying down the balance.

- Outdated contact details: With approximately 10% of the U.S. population relocating annually, it becomes important to maintain accurate contact information (AppFrontier). Depending on the company’s billing procedures, an incorrect billing address could lead to a payment failure. This is even more of an issue for businesses reliant on physical bills, as the bills wouldn’t reach their customers.

Hard Declines

This occurs when the issuing bank does not approve the payment. Hard declines are permanent, meaning that the payment info on file is unlikely to be valid again. Here are the common causes of hard payment declines.

- Lost or stolen credit cards: If a card is reported lost or stolen, all transactions, including recurring payments, will be declined to protect the cardholder.

- Invalid or expired credit card: Payment information can change for many reasons. Credit cards have expiration dates, and customers might receive new cards due to technological upgrades, like chip cards. When this happens, you will need the new expiration date and CVV code in order to process the transaction.

Missing Paperwork

Besides payment issues, missing paperwork or signatures could lead to involuntary churn. Some industries require specific paperwork or agreements for service renewals. For example, healthcare providers may need updated insurance or compliance forms, adding a layer of complexity beyond mere payment updates. Another common example is apartment rentals, which require a new signed lease to continue tenancy. If businesses can’t reach a customer to obtain the signed paperwork, there may be no choice but to suspend or terminate service.

Strategies To Address Involuntary Churn

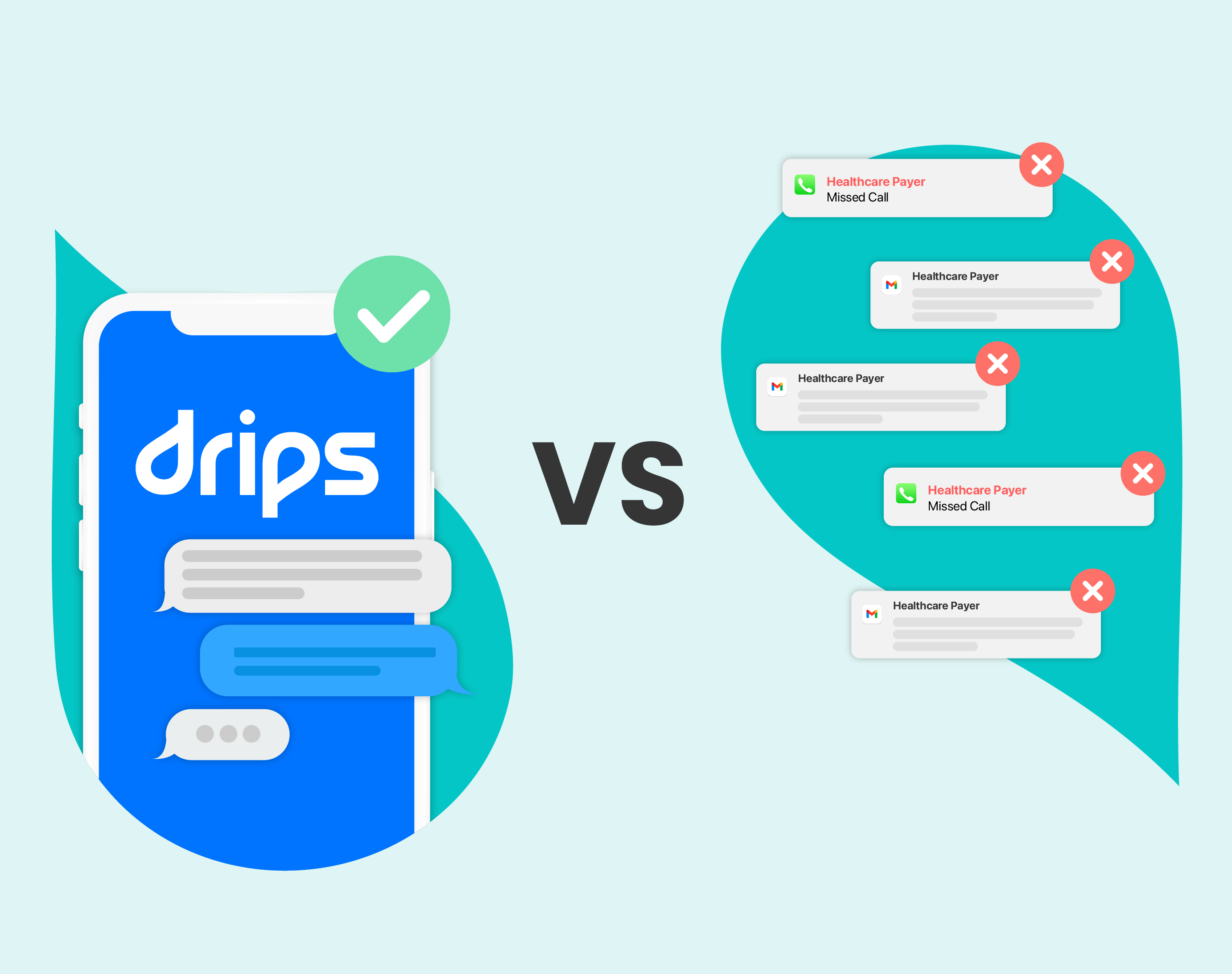

Effectively combating involuntary churn requires a multifaceted approach that addresses all these different issues. For payments, you could pay for a service that sends reminders on your behalf (called “automated dunning” in payment jargon). Similarly, digital paperwork providers like DocuSign integrate email reminders to encourage more customers to sign contracts. However, tough-to-reach customers often won’t see these reminders in already cluttered inboxes.

Rather than addressing these problems piecemeal with multiple tools, you could address the underlying problem. Namely, a gap in communication with your customers. Text messaging (SMS) is a powerful way to bridge the gap for urgent yet sensitive issues like missed payments.

Consumers prefer SMS for its immediacy and user-friendly nature. That means more responses and more action from customers to resolve issues before they churn. To fully address the communication gap, it’s best to use SMS outreach both before and after issues arise.

Pre-Issue Outreach

Sending well-timed texts ahead of card expiration or renewal dates to remind customers of updating payment details helps in reducing failed payments. SMS has an exceptionally high open rate — as high as 98% (Dexatel). This reach, along with the convenience of conversing any time, anywhere, enables critical billing communications to capture immediate attention amidst the barrage of daily messages.

Post-Issue Engagement

SMS can be leveraged to alert customers after there is a failed payment. SMS can also be used to lead into more hands-on assistance, such as by scheduling a meeting with a customer support agent.

Importantly, SMS gives a low-pressure way to continue outreach even when initial alerts don’t work. Repeated calls or scary bills in the mail can hurt your image in customers’ minds. On the other hand, carefully worded texts give customers the option of reading and responding when they feel comfortable, leading to better results.

Go Beyond Churn Prevention With Proactive SMS

Proactive SMS outreach represents more than a band-aid solution for involuntary churn. By improving your customer communication using SMS, you can see benefits in every aspect of your customer experience. It enables you to nurture enduring relationships, understand customer needs, and deliver a customer experience that builds value for both your business and your customers.

These benefits can be enhanced further by adopting a conversational outreach strategy. Conversational outreach, offered as a managed service by specialized vendors like Drips, uses AI to enable two-way dialogue that keeps customers engaged throughout key moments in the consumer journey.

Using conversational outreach, you can:

- Engage new customers with a welcome campaign. (This is also a great opportunity to get them enrolled in autopay and cut down on involuntary churn!)

- Maintain brand recognition even during slow seasons.

- Provide helpful content to increase satisfaction with your product or service.

- Uncover pain points and opportunities to improve your services.

- Boost engagement for industry-specific programs, such as comprehensive medication reviews for healthcare payers.

If you want to explore how to achieve these benefits with the ease of a managed service approach, please get in touch with the Drips team here.

The Importance Of Addressing Involuntary Churn

Involuntary churn poses a significant threat and requires a comprehensive solution. While understanding the specific causes of churn is vital, it’s best to take a holistic approach to reduce churn by improving customer engagement. Proactive SMS stands out as the best engagement strategy, either as a replacement for calls and emails or as an additional channel. Its immediate and user-friendly nature bridges communication gaps, mitigating disruptions and fostering lasting engagement.