How a Regional Insurance Company Innovated Their Outreach Strategy with Drips Conversations as a Service

Challenge

As one regional insurance company began a digital transformation initiative, they recognized the need to overhaul their customer engagement processes. Legacy systems and workflows resulted in labor-intensive efforts to leverage marketing efforts for lead generation with effective conversion rates. Additionally, the traditional outbound dialing approach posed scalability and workforce management challenges, hindering their ability to capitalize on online engagement effectively.

Over the last several years, the company has significantly improved their digital insurance shopping experience. As they saw an uptick in the volume of online quotes, there was a decrease in the rate of leads contacted in a timely manner. The linear relationship between the number of online quotes generated and the number of staff required to work them created a bottleneck in the effort to gain efficiency at this new scale.

Driven by a commitment to modernize its outreach efforts and improve the workforce experience, the insurance company set forth clear objectives as a part of their digital transformation initiative. These goals included finding an optimal balance between forecasted volume and required headcount, improving conversion rates, reaching untapped customer segments, and optimizing the agent experience while also addressing evolving customer preferences.

Remaining Ahead of the Curve on Compliance with the FCC TCPA Rules Around Express Written Consent

TCPA compliance is top of mind when making any changes to how the company would design any outbound activity. The team looked at taking a conservative approach by requiring consent from prospects when they begin the quoting process. Their website team had concerns that requiring prospects to provide express written consent during the quoting process would decrease online conversion rates. After exhaustive A/B testing, it was determined that while less committed consumers were lost, the impact was nominal to their growth goals.

Fast-changing regulations continue to be a major challenge for companies looking to reach out to their audiences. The insurer's straightforward approach to express written consent will set them up for success in the future, specifically with the new rules announced in February 2024 around consent revocation by any reasonable means.

Solution

The company quickly narrowed their search to Drips as a managed service provider of choice to help deliver timely and meaningful contacts in their digital insurance shopping, and overall customer experience (CX), for visitors that went through the quoting process but did not buy. Just prior to engaging with Drips, they had recently migrated their CRM system to Salesforce. This allowed the discussion to move forward quickly as they would be able to use the cost-effective and trusted Drips Salesforce App Exchange Connector to share data with Drips.

The company engaged in a formal discovery process beginning with a comprehensive audience and consent review, coupled with a strategic use case assessment and performance benchmarking which is the foundation that sets the stage for personalized and effective engagement in any Drips program.

Implementation Strategy

Drips and the insurance company initiated a phased rollout, starting with a pilot program to ensure minimal disruption to existing operations. Close collaboration between marketing, call center, and IT teams facilitated seamless integration and adaptation to the new technology. The company wanted to ensure that their user base was receptive to outreach through text messaging, using leading indicators of engagement rate, transfer rate, and disqualify rate to measure and make sure that these metrics were all in line, if not performing better than their current model benchmarks.

Another area of focus for implementation was looking at the agent experience. The insurance company admittedly had an outbound dialing call center culture. It was unknown if agents would be able to adapt to this new inbound lead distribution model. The majority were very receptive, sending notes like, “This is so easy” and, “I’m talking to prospects who are ready to buy” to their managers. New staffing models were needed to make sure the agents were there and ready to take the inbound activity.

The company’s marketing team worked closely with their workforce management team to ensure that they were able to adjust their staffing schedules to accommodate the new model in which incoming calls from the Drips program were people warmed up and ready to talk to a licensed agent about adding a policy.

The brand affinity was important to maintain. The organization registered all the phone numbers being used by Drips with the carriers and used branded caller ID. A lot of time was spent up front with the Drips scripting team to ensure that the brand voice was consistent to the advertising that got the prospect onto the company's website in the first place.

Reporting and sharing information on how Drips was engaging was also critical. The marketing team brought sample conversations to exhibit the flow and show the natural cadence of how Drips effectively warmed up and transferred in a prospect ready to engage.

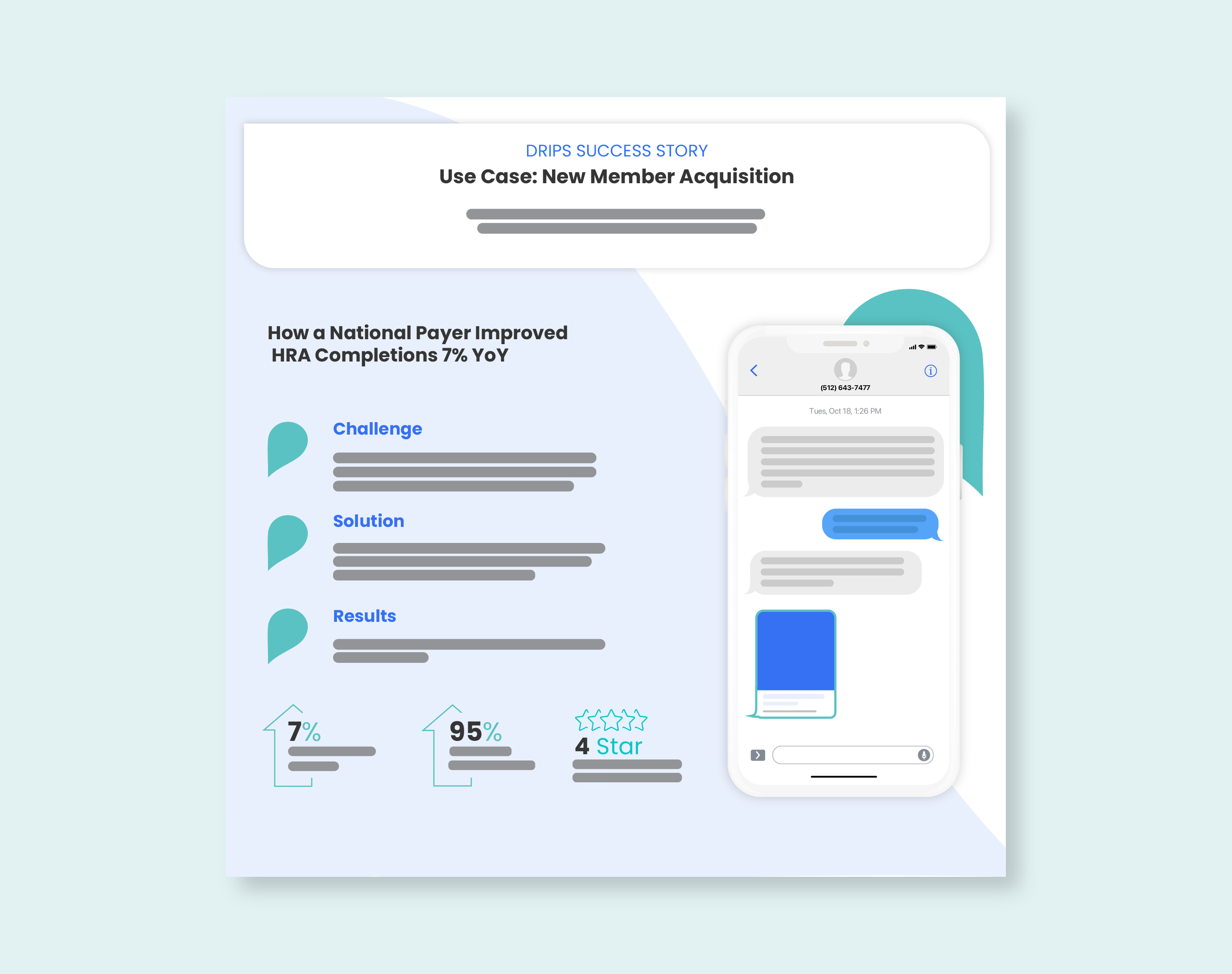

Outcomes and Results

As of April 2024, all integrations are in place and 100% of online abandoned leads are now routing to the Drips Conversations as a Service engine.

The implementation of Drips yielded remarkable outcomes for the insurance company across various performance metrics. In fact, Drips outperformed manual agent outreach by a substantial 25% increase in conversion rates over the traditional method. Additionally, the company recognized financial benefits from improved workforce efficiency. The average customer age decreased by one year, reflecting a more inclusive and contemporary outreach approach. Furthermore, the success of the initiative garnered recognition in the industry and positioned the company as a trailblazer in leveraging technology to drive customer-centric innovation.

Bolstered by the success of its digital transformation initiative, the insurance company is poised to explore further opportunities for enhancing customer experience and operational efficiency. They are actively exploring new use cases with Drips in their other product lines, underscoring their commitment to continuous improvement and innovation.

.png)